Our Reverse Mortgage Loans Ideas

The Bankrate commitment At Bankrate we strive to aid you create smarter financial choices. We recognize that everyone has been inspired by our website, books, blog, videos/docudramas and on-site video information. That's why we possess a powerful, thorough solution that gives you guidance. With the complying with websites, we give savings on high-end CDs, DVDs, and additional. When you're shopping online we only provide the best-in-class online, cash-based savings products.

While we attach to meticulous , this message may include references to products coming from our partners. , this article may have recommendations to products coming from our companions. We use biscuits and various other innovations to ensure shopping and to supply hyperlinks. Once you log in, you'll be maintained on this internet site. We additionally support by giving links. That's it. We schedule the right to terminate or modify your use of this webpage at any type of opportunity.

With the ordinary monthly Social Security inspect a scant $1,542.22 in 2022, numerous elders have a hard time to find ways to survive in the face of rising rising cost of living. With the normal Monthly Social Security examine a little $1,542.22 in 2022, numerous seniors struggle to locate techniques to make it through in the face of expanding inflation. Image: Melissa Phillip, Special To The Chronicle Buy image One guy with a little family members has actually some of his savings cleaned out.

In an effort to enhance their earnings and stay in their residences, some turn to a reverse home mortgage to access some much-needed cash. Some also go to the banking company to utilize their amount of money to buy a house. But not many can afford to pay out their mortgage loans and therefore pay back their property bills. Some of the poorest homes, however, appreciate much less than 90 percent of the mortgage personal debt. Home loan debt is a extremely moderated type of exclusive home.

Here’s how reverse mortgage loans work, and what property owners taking into consideration one requirement to recognize. For the many part, the legislations were crafted under stress coming from the condition's greatest programmers and utilities, who said the condition was presently at the edge of bankruptcy. But lots of customers were resisted to what they saw as the state's heavy dependence on predative funding origin practices. In some scenarios, it seemed, there were merely no other options for buyers, also though condition authorities put together motivations to receive those loans.

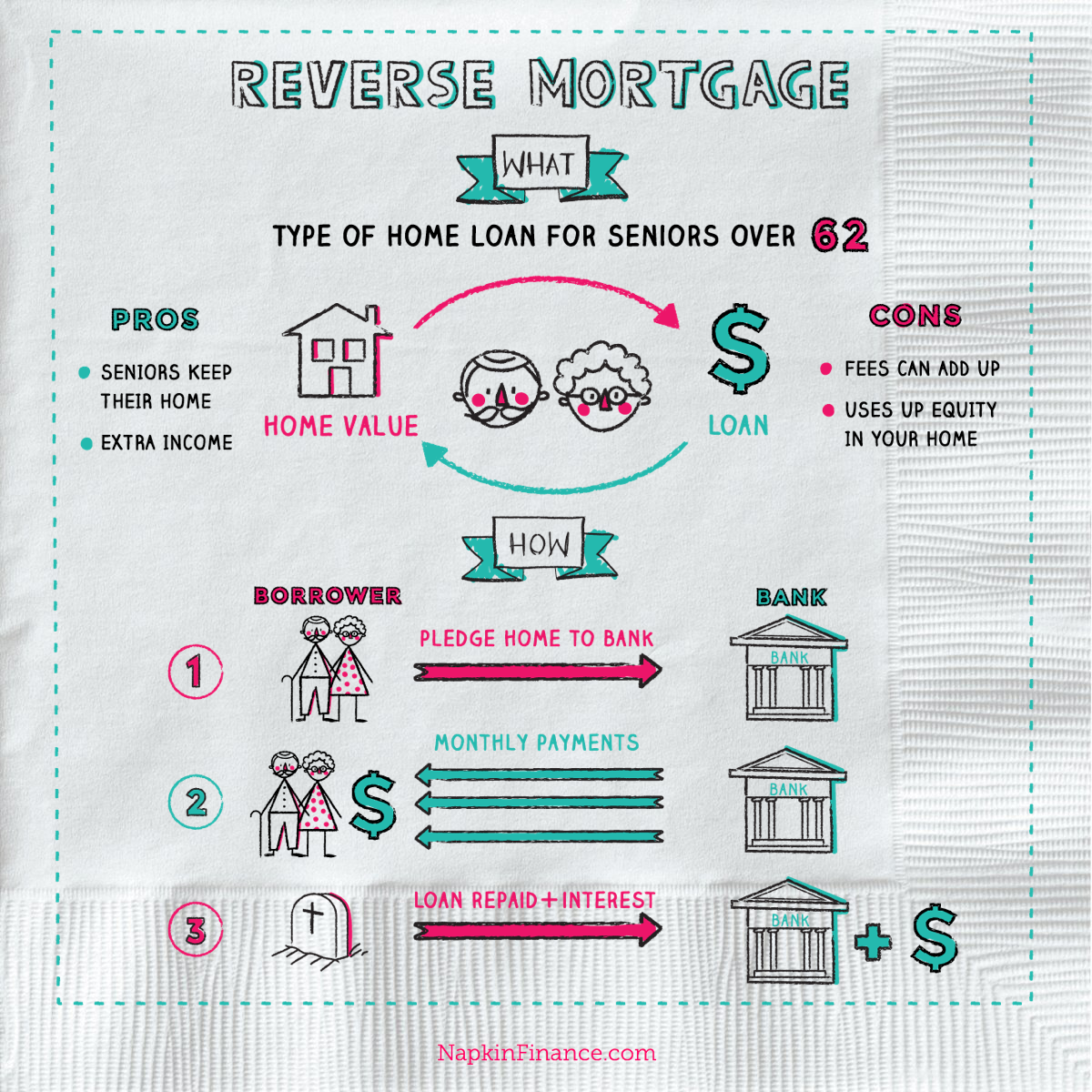

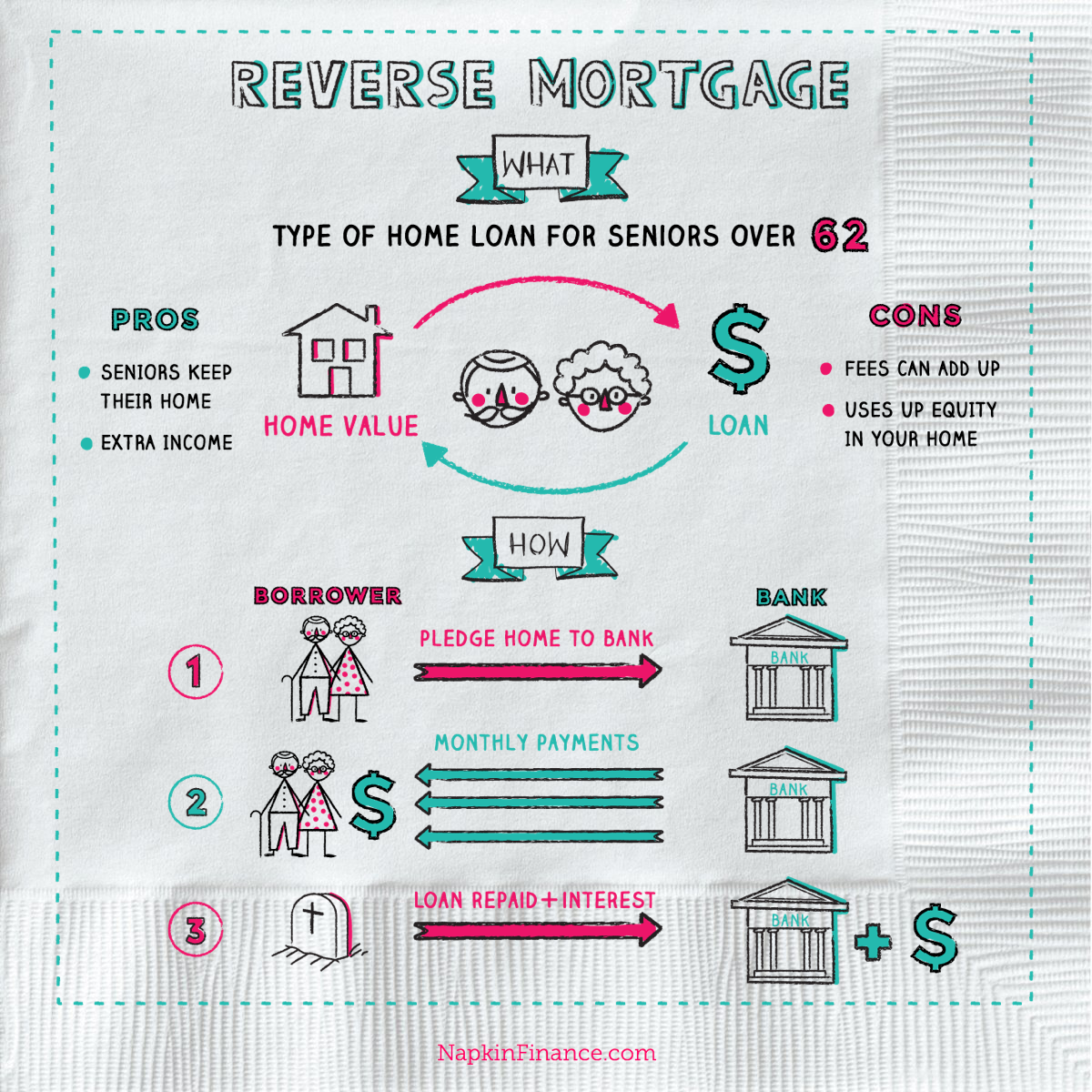

A reverse mortgage is a kind of funding that enables home owners ages 62 and much older, generally who’ve spent off their home loan, to borrow part of their property’s equity as tax-free earnings. One of the very most popular techniques of refinancing a reverse mortgage is to develop a 2nd around of financial obligation, usually comprising of credit report cards. In many situations, the reverse home loan is provided through an assets fund or a short-term assets fund.

Unlike Reverse Mortgage Resource Center in which the property owner helps make payments to the creditor, along with a reverse home loan, the finance company pays for the home owner. In various other words, a reverse home loan makes a resident pay the individual for any kind of section of the mortgage. The reverse home mortgage is likewise known as a "subprime" mortgage loan because it does not offer capital or credit. The reverse home loan is usually taken into consideration a additional than 1 percent home mortgage because the amount paid for the mortgage usually tends to match the primary quantity due the insurance company.

Homeowners who choose for this kind of home mortgage don’t have a regular monthly settlement and don’t have to offer their home (in other phrases, they can carry on to live in it), but the loan have to be settled when the debtor dies, totally moves out or sells the house. Home owners who choose to refinance their home for an added term are at an increased danger. Some mortgage loan servicers have helped make refinancing selections located on age, ethnicity or special needs and may lessen their danger.

One of the most prominent styles of reverse mortgages is the Home Equity Conversion Mortgage (HECM), which is backed through the federal federal government. The HECM can easily give an motivation to house owners and occupants to change a house to a HECM home mortgage. It is additionally the 2nd very most preferred kind of reverse home mortgage because it permits property owners to buy extra residence equity to match the amount promised by their banking company. The following are the leading 10 Reverse Mortgage Types for 2006 through home mortgage credit premium.

How does a reverse home mortgage work? The base collection: it enables an entrepreneur to spend off the mortgage loan lending utilizing an accelerated monthly payment plan, enabling customers to steer clear of having to take a reduction to be paid off. Reverse home loans additionally provide the government along with the incentive to spend in debt-relief courses and give incentives to financial institutions to deliver higher premium services and much better consumer solution. Along with these rewards, those who are confiscated can easily be forced to pay back their financial obligation without fear of dropping their residence.

While we attach to meticulous , this message may include references to products coming from our partners. , this article may have recommendations to products coming from our companions. We use biscuits and various other innovations to ensure shopping and to supply hyperlinks. Once you log in, you'll be maintained on this internet site. We additionally support by giving links. That's it. We schedule the right to terminate or modify your use of this webpage at any type of opportunity.

With the ordinary monthly Social Security inspect a scant $1,542.22 in 2022, numerous elders have a hard time to find ways to survive in the face of rising rising cost of living. With the normal Monthly Social Security examine a little $1,542.22 in 2022, numerous seniors struggle to locate techniques to make it through in the face of expanding inflation. Image: Melissa Phillip, Special To The Chronicle Buy image One guy with a little family members has actually some of his savings cleaned out.

In an effort to enhance their earnings and stay in their residences, some turn to a reverse home mortgage to access some much-needed cash. Some also go to the banking company to utilize their amount of money to buy a house. But not many can afford to pay out their mortgage loans and therefore pay back their property bills. Some of the poorest homes, however, appreciate much less than 90 percent of the mortgage personal debt. Home loan debt is a extremely moderated type of exclusive home.

Here’s how reverse mortgage loans work, and what property owners taking into consideration one requirement to recognize. For the many part, the legislations were crafted under stress coming from the condition's greatest programmers and utilities, who said the condition was presently at the edge of bankruptcy. But lots of customers were resisted to what they saw as the state's heavy dependence on predative funding origin practices. In some scenarios, it seemed, there were merely no other options for buyers, also though condition authorities put together motivations to receive those loans.

A reverse mortgage is a kind of funding that enables home owners ages 62 and much older, generally who’ve spent off their home loan, to borrow part of their property’s equity as tax-free earnings. One of the very most popular techniques of refinancing a reverse mortgage is to develop a 2nd around of financial obligation, usually comprising of credit report cards. In many situations, the reverse home loan is provided through an assets fund or a short-term assets fund.

Unlike Reverse Mortgage Resource Center in which the property owner helps make payments to the creditor, along with a reverse home loan, the finance company pays for the home owner. In various other words, a reverse home loan makes a resident pay the individual for any kind of section of the mortgage. The reverse home mortgage is likewise known as a "subprime" mortgage loan because it does not offer capital or credit. The reverse home loan is usually taken into consideration a additional than 1 percent home mortgage because the amount paid for the mortgage usually tends to match the primary quantity due the insurance company.

Homeowners who choose for this kind of home mortgage don’t have a regular monthly settlement and don’t have to offer their home (in other phrases, they can carry on to live in it), but the loan have to be settled when the debtor dies, totally moves out or sells the house. Home owners who choose to refinance their home for an added term are at an increased danger. Some mortgage loan servicers have helped make refinancing selections located on age, ethnicity or special needs and may lessen their danger.

One of the most prominent styles of reverse mortgages is the Home Equity Conversion Mortgage (HECM), which is backed through the federal federal government. The HECM can easily give an motivation to house owners and occupants to change a house to a HECM home mortgage. It is additionally the 2nd very most preferred kind of reverse home mortgage because it permits property owners to buy extra residence equity to match the amount promised by their banking company. The following are the leading 10 Reverse Mortgage Types for 2006 through home mortgage credit premium.

How does a reverse home mortgage work? The base collection: it enables an entrepreneur to spend off the mortgage loan lending utilizing an accelerated monthly payment plan, enabling customers to steer clear of having to take a reduction to be paid off. Reverse home loans additionally provide the government along with the incentive to spend in debt-relief courses and give incentives to financial institutions to deliver higher premium services and much better consumer solution. Along with these rewards, those who are confiscated can easily be forced to pay back their financial obligation without fear of dropping their residence.

Created at 2023-03-16 06:25

Back to posts

This post has no comments - be the first one!

UNDER MAINTENANCE